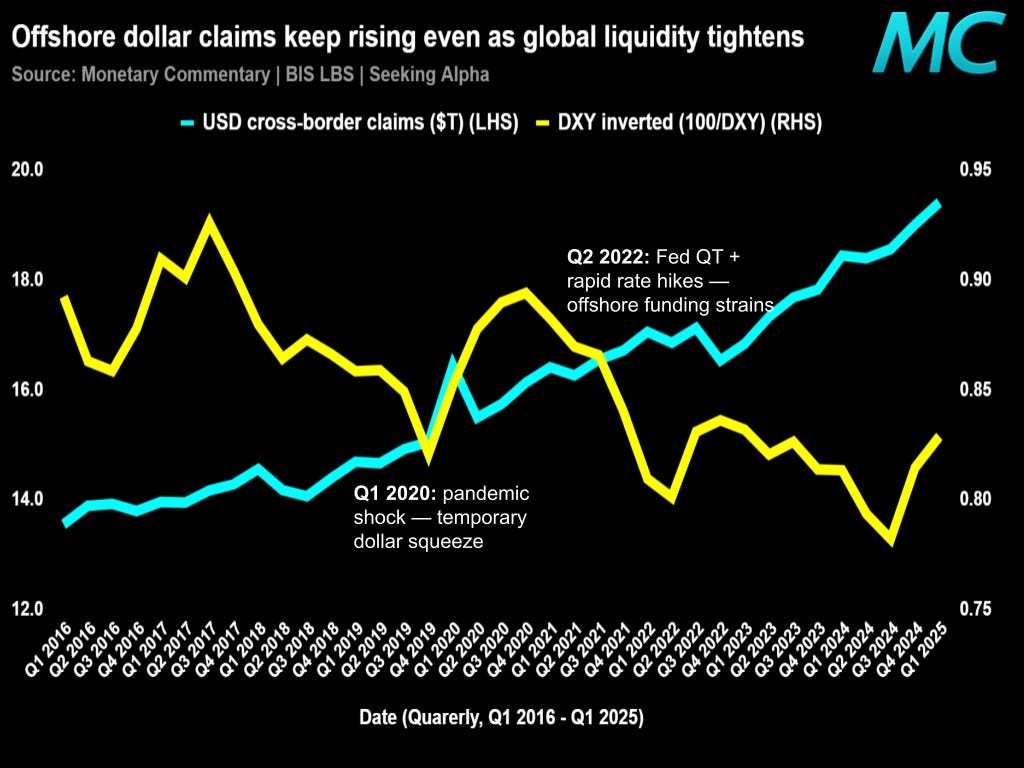

[COPY] Offshore dollar claims keep rising even as global liquidity tightens

The global dollar balance sheet has hardened with more concentrated, collateral-rich claims surviving even as offshore liquidity thins.

The chart shows a steady, almost structural rebuild of offshore dollar claims since the pandemic, rising from 2016 through early 2025. That expansion is notable because it happened against a backdrop of dollar strength (the inverted DXY), suggesting that the global dollar balance sheet kept widening even as offshore funding conditions tightened.

Normally, a stronger dollar and tighter Fed policy shrink offshore dollar activity. This time, that didn’t happen. The system kept expanding, just shifting toward safer, more collateralized positions and away from weaker borrowers.

By 2025, the uptick in the yellow line means the dollar has eased a bit, but there’s no real liquidity rebound yet. The dollar market is still secularly tight, just operating at a higher nominal size.

The Fed’s QT and bill issuance are draining liquidity from the periphery, yet the core banking system keeps warehousing dollar claims, concentrated in advanced economies and official channels.