Greenland’s strategic premium rises as Arctic ice retreats

Shrinking sea ice turns Greenland from geography into infrastructure, and markets lag the state.

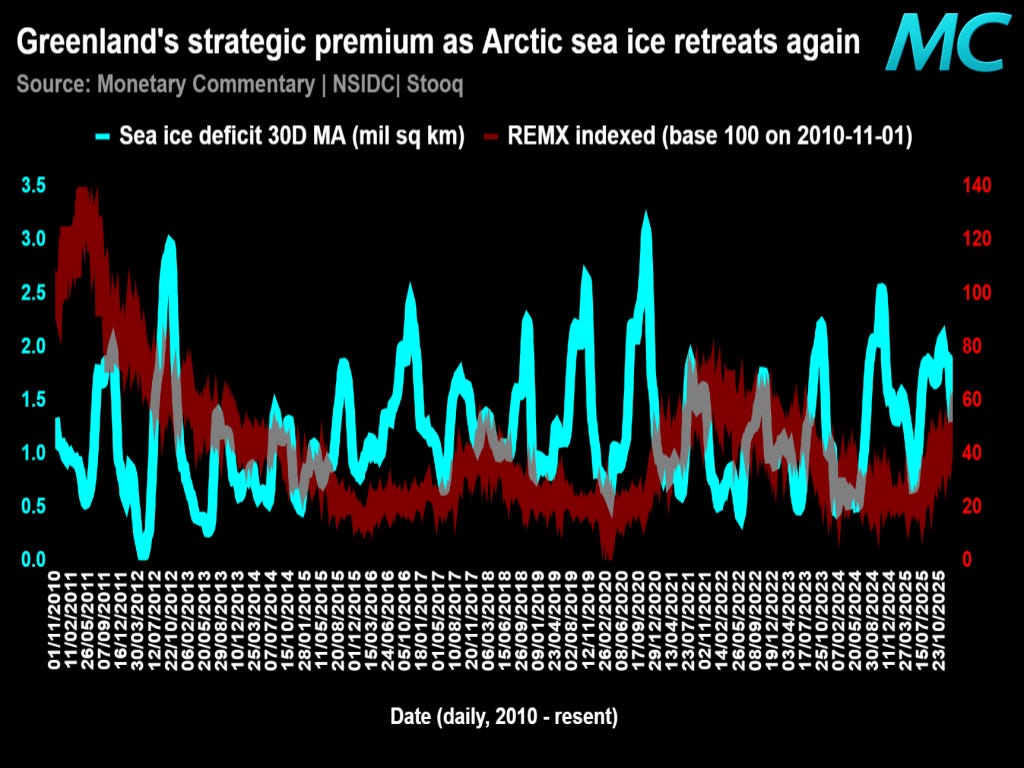

$REMX trades like a China policy barometer and a global risk appetite sleeve, so it only sporadically “hears” the Arctic story, even when sea ice deficits are screaming that physical access is widening. That gap is the Greenland trade. Sea ice retreat is not a neat catalyst for listed rare earth equities, but it steadily turns Greenland from a map asset into an operating asset by lengthening work seasons, lowering logistics friction, and making the economics of marginal deposits and supporting infrastructure less absurd, which is where the strategic premium actually lives.

When Washington flirts with control rhetoric, it is rarely about buying REMX exposure; it is about underwriting the chokepoints and the supply chains at once, basing and ISR in the near term, then locking up permitting, ports, power and offtake in a world that is relearning that “secure” beats “cheap.”

The historical rhyme is Cold War Greenland as a fixed military platform; climate makes it a floating option on access and scarcity, and options get repriced in deals and budgets before they show up in an ETF line.