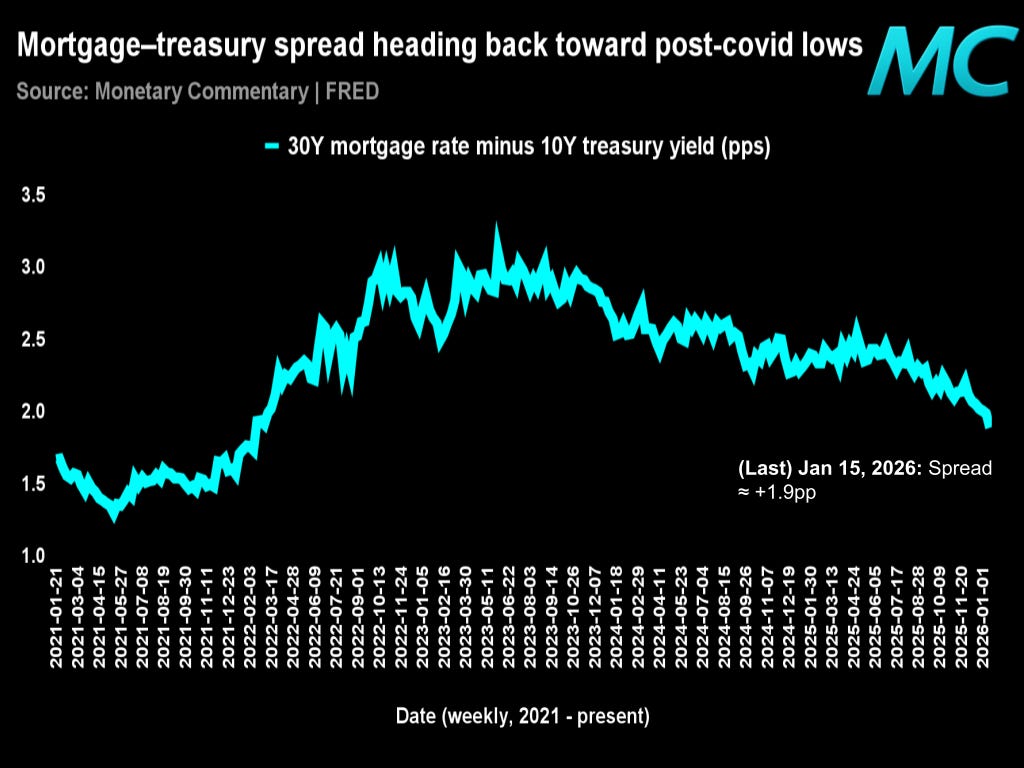

Mortgage–treasury spread slides toward post-covid lows

Basis compression is easing mortgage rates without help from Treasuries.

A mortgage–treasury spread sliding back toward post-Covid lows is stealth easing even when the 10Y refuses to cooperate, because every basis point of spread compression translates into a lower mortgage rate without any Fed pivot theatrics, and that usually means the MBS basis is tightening as rate volatility calms, pipeline hedging costs fall, and dealer balance sheet stops charging quite as much rent for carrying convexity.

Housing’s constraint shifts away from financial plumbing back toward real constraints like inventory, incomes and lock-in, which is exactly how you end up with activity that refuses to die and shelter inflation that stays annoyingly resilient even in a higher-for-longer tape, while banks get incremental relief on their mortgage book marks as the basis heals.