The new productivity mirage

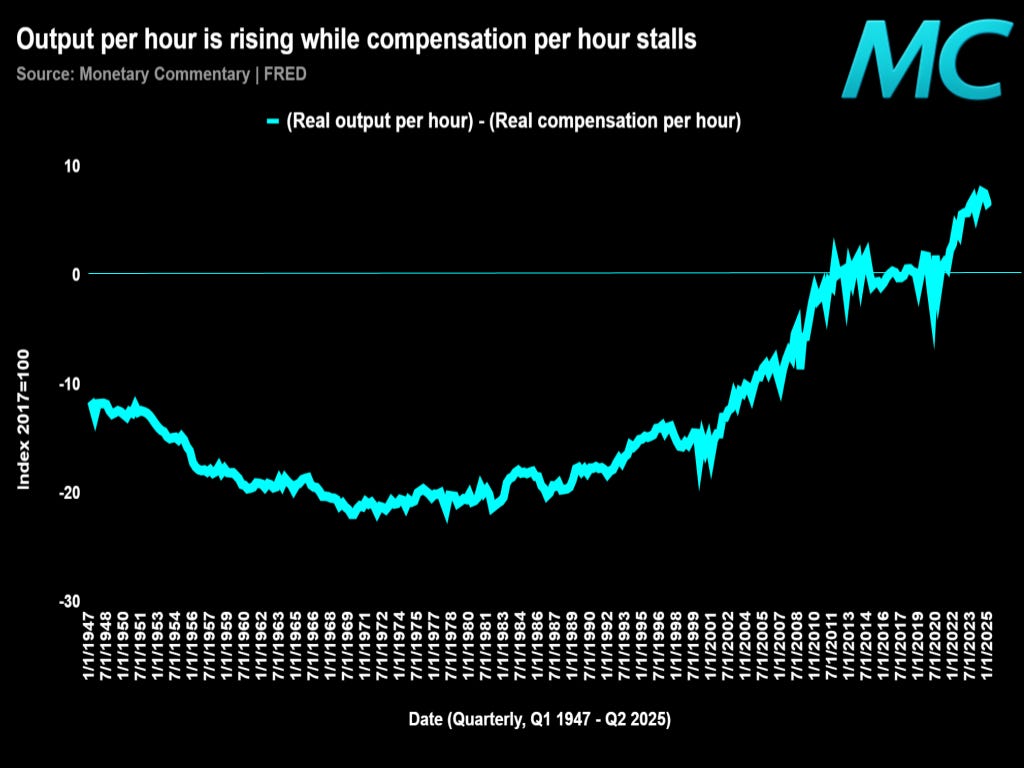

Productivity is back, but workers aren’t seeing a cent of it — it’s all flowing straight to margins.

The gap between productivity and pay has reopened, and this time it’s not globalization or offshoring doing it. Rather, it’s capex-heavy automation and price stickiness.

Real output per hour has accelerated again since late 2022, while real compensation per hour is flat to down, implying that the entire productivity dividend is accruing to capital rather than labor.

It’s the mirror image of the 1970s, when compensation outpaced productivity and inflation crushed margins.

Today, margins are protected by pricing power, while labor’s share erodes beneath nominal wage growth. The Fed reads this as disinflationary, but it’s really just redistributionary.

The more capital-intensive the expansion becomes, the more the wage-output gap widens, embedding inequality structurally into the next cycle.